Evolution of the 3 important legal changes that will affect companies and self-employed workers with economic activity:

1) The anti-fraud law “Verifactu”; 2) The Electronic Invoicing and Late Payment Law “Crea y Crece”; and 3) The Franchise regime.

09/12/2024

Boosting Billing with a3factura software: Efficiency and Compliance with Legislation

Puigverd Assessors recommends reviewing the billing software to verify that it adapts to the first two changes reported. If you do not have billing software , a3factura is positioned as a key tool for companies seeking to comply with the provisions of the Anti-Fraud Law "Verifactu" and the Electronic Invoicing Law "Crea y Crece" . This program not only simplifies the issuance of electronic invoices and compliance with Verifactu, but also offers advanced functions for the monitoring and comprehensive management of tax documents, also facilitating the exchange of information with our office. It is important not to wait until the last minute, which is why we recommend the implementation of this software in 2025.

The “Verifactu” anti-fraud law

This legislation promoted by the Tax Agency has the main objective of combating tax fraud and promoting the digitalization and automation of corporate tax processes.

On October 17, 2024 (BOE 10/28/2024), the Ministry of Finance issued Order HAC/1177/2024, establishing the technical requirements for billing systems used by entrepreneurs and professionals. This Ministerial Order completes all the regulations regarding billing systems (Law 11/2021 Tax Fraud Prevention (10/11/2021); RD 1007/2023 (12/5/2023) Regulation; OM HAC/1177/2024). Since the publication of the OM, billing software manufacturers have 9 months to adapt the SIF Billing Computer Systems, a deadline that ends on July 29, 2025).

The Ministerial Order establishes a series of technical requirements that all billing systems must meet to ensure proper standardization and operation:

- Certification: Billing computer systems must be able to generate standardized and verifiable records, allowing data validation by the Tax Administration.

- Voluntary referral: Although it is optional, the use of VERI*FACTU facilitates the direct referral of billing records to the tax authorities, which represents an advantage in terms of speed and transparency.

- Invoice Standardization: Systems must comply with specifications for the format and visual elements of invoices, such as the inclusion of a QR code to ensure traceability and verification.

To help companies comply with this regulation, the Tax Agency has made available a series of guides and specifications on its electronic site, as well as frequently asked questions. In addition, developers of invoicing software have the responsibility of ensuring that their applications comply with the new standards, particularly those related to the issuance of electronic invoices and the standardization of tax records. This is the link to the Tax Agency's electronic site: https://sede.agenciatributaria.gob.es/Sede/iva/sistemas-informaticos-facturacion-verifactu.html

Entry into force: Currently, taxpayers must comply with the regulations before July 1, 2025. (RD 1007/2023 of 12/5/2023). This deadline is prior to the end of the deadline for software manufacturers to adapt their Billing Computer Systems (SIF) to the regulations. Therefore, a modification of Regulation RD 1007/2023 is already being prepared with the following proposal pending approval :

- Exclusive distribution of SIF – Computerized billing systems adapted to the new regulations: 07/29/2025 .

- VERI*FACTU entry into force: 01/01/2026 Taxpayers Corporate Tax

- VERI*FACTU entry into force: 01/07/2026 Self-employed

The Electronic Invoicing Law "Creates and Grows"

In the current digital era, legislation is advancing to adapt to new technologies and improve efficiency in business processes. This legislation promoted by the Ministry of Economic Affairs and Digital Transformation (Adaptation to Community Directives) aims to promote the use of electronic invoicing in commercial transactions between entrepreneurs (companies and self-employed) "B2B" and the reduction of late payments in commercial operations . These would be the main points of this law:

- All entrepreneurs (companies and self-employed persons) must issue, send and receive electronic invoices in commercial relations with other entrepreneurs (companies and self-employed persons) B2B.

- All entrepreneurs (companies and self-employed) must use technological solutions that guarantee interconnection and interoperability between different platforms free of charge.

- All entrepreneurs (companies and self-employed) must accept or reject electronic invoices received electronically and report the invoice payment date electronically within certain time periods.

- The entry into force of the issuance of electronic invoices is pending the approval of the Regulations of the Electronic Invoice Law "Crea y Crece". This approval is being delayed for technical reasons given its complexity and at present there is no news of the approval date. The deadlines would be as follows:

- Companies and self-employed workers with a turnover of more than €8M/year must issue electronic invoices 12 months after the approval of the Regulation

- Companies and self-employed persons with a turnover of less than €8M/year must issue electronic invoices 24 months after the approval of the Regulation . However, clients with a turnover of more than €8M can require or recommend that their suppliers issue electronic invoices before this date.

- Entry into force of the obligation to report on the status of the invoice received (accepted, rejected) and the payment date will vary depending on the volume of invoicing, and the type of entrepreneur (company, self-employed professional, other self-employed). Forecast of 36/48 months from approval of the Regulation for communication of the effective payment date.

- Penalty regime: Up to €10,000 for companies that are required to do so but do not offer users the possibility of receiving electronic invoices.

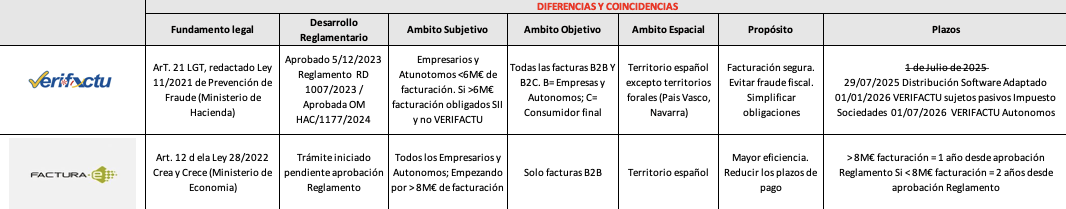

- Table of differences between the Anti-Fraud Law – Verifactu and the Create and Grow Law – Electronic Invoice.

Franchise Regime: Stimulus to Investment and Business Development

It is a draft project that is presented as an attractive option to promote investment and business development. Although it appears in the media, there is no project pending approval at this time . We do not believe it will be implemented in the short term.

This regime offers tax benefits and administrative simplifications that encourage business expansion under the franchise model. These are the main points of this draft project:

- Applicable to self-employed persons with economic activity, although companies may be included.

- This regime would mean not having to invoice VAT, and therefore not being able to deduct VAT.

- Voluntary regime (Not all those obliged find it profitable to apply it).

- Applicable to activities with an annual turnover (billing) of less than €80,000 / €85,000.

- The obligation to bill and register remains.

- Special regimes disappear: Equivalence Surcharge, Modules (Simplified VAT regime and Objective Income Estimation). For everyone, whether or not they opt out of the system.

- Specific activities or operations may be excluded (transport sector, occasional property sales, vehicle deliveries, etc.)

- Entry into force. No forecast.